The past years have witnessed a growing interest in studying firm market power in labor markets. Two critical questions are: Which firms exercise labor market power and how does firms’ labor market power shape firms’ wage differences? Addressing these questions is vital in the context that growing wage differences have been predominantly driven by increasing differences in average firm wages (e.g., Song et al., 2019). Moreover, understanding which firms exert labor market power and whether low wages reflect low productivity or high firm labor market power is pivotal for formulating effective labor market policies, such as minimum wages.

In a recent article, Labor Market Power and Between-Firm Wage (In)Equality, Matthias Mertens sheds new light on these issues by leveraging rich data on German manufacturing firms. Labor market power can be defined as the extent to which wages deviate from marginal revenue products. On competitive markets, wages equal the marginal revenue product, whereas firms (workers) possess labor market power if wages are below (above) marginal revenue products. Employing modern estimation approaches for firm- and year-specific labor market power measures, the study documents a surprising finding: Small, low-productivity, low-paying firms do not wield labor market power over their workforce. Instead, they pay competitive or even above-competitive wages given their productivity. Conversely, high-paying, large, and highly productive firms exercise considerable labor market power and pay wages below the competitive benchmark.

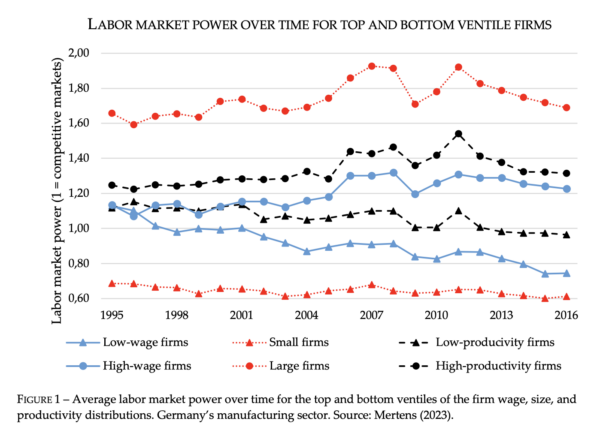

Figure 1 illustrates these disparities in labor market power among different firm types, plotting the evolution of average labor market power in the top and bottom 5% of the size, productivity, and wage distributions. As shown, the largest, most productive, highest paying firms exhibit the highest labor market power levels that are far above the competitive value of one. Contrarily, the firms at the bottom of the distributions have low labor market power levels, indicating that these firms pay, on average, wages above marginal revenue products, which is indicative of rent-sharing processes in these firms. Over time, these disparities in labor market power between top and bottom firms have widened. Based on European cross-country data from CompNet, the study also shows that most of these findings hold across several European countries and also outside of the manufacturing sector.

What are the implications of these findings? Firstly, in a counterfactually competitive market scenario, inequality in average wages between firms would intensify. Labor market power thus contributes to between-firm wage equality as high-paying firms underpay their workers, while low-paying firms overpay their workers relative to the competitive benchmark. Secondly, holding other things fixed, the recent increase in wage differences between firms, which accounts for most of the increase in overall wage inequality, was moderated by increasing differences in labor market power between firms. Based on rough back-of-the-envelope calculations, the study suggests that if the distribution of labor market power had remained constant since 1995, wage differences between firms would have been 11% lower. Finally, the study suggests that low-paying firms do not necessarily pay lower wages due to labor market power but because of their low productivity. Binding minimum wages could render these firms unprofitable and force them to exit the market. This underscores the importance of considering the distribution of labor market power across firms when designing labor market policies. Understanding the characteristics of labor market power remains a crucial area for future research.

(Full paper published in IJIO Volume 91, December 2023)

References

Mertens, M. (2023). Labor Market Power and Between-Firm Wage (In)Equality. International Journal of Industrial Organization, 91, 103005.

Song, J., Price, D. J., Guvenen, F., Bloom, N., & Von Wachter, T. (2019). Firming Up Inequality. The Quarterly journal of economics, 134(1), 1-50.